35+ mortgage backed securities pricing

Special Offers Just a Click Away. Mortgage-Backed Securities Index is a rules-based market-value-weighted index covering US.

Mortgage Backed Securities Mbs

Web We implement a Mortgage Backed Security MBS pricing tool.

. Web The mortgage-backed security MBS market plays a special role in the US. Get Instantly Matched With Your Ideal Mortgage Lender. MBS are securities created from the pooling of.

35 117 46 198 88 240 26 38 90 167 242. Web For investors mortgage-backed securities have some advantages over other securities. There are a variety of structures in the MBS market but.

They pay a fixed interest rate that is usually higher than US. Web Residential mortgage-backed securities generally settle within 180 calendar days and include commitments associated with outright transactions dollar rolls and coupon swaps. Web A Mortgage-backed Security MBS is a debt security that is collateralized by a mortgage or a collection of mortgages.

Web Mortgage-Backed Securities MBS Market Leaders Tradeweb is the largest and most efficient electronic trading platform for the To-Be-Announced TBA MBS market with daily executed volumes of 170 billion FY22. Web The SP US. Ad Educational Resources to Guide You on Your Path to Becoming an Even Smarter Investor.

Web Real Estate Mortgage Investment Conduits REMICs feature customized structuring of mortgage pass-through securities to redistribute cash flows. Ad Rich options pricing data and highest quality analytics for institutional use. Web Mortgage-backed securities MBS and collateralized mortgage obligations CMO are an increasingly popular and important class of financial instruments.

The model employs a Hull-White single-factor short rate model calibrated to the swaption volatility matrix. Analytic and Tick Data. As of June 2000 the.

Deep Historical Options Data with complete OPRA Coverage. This process is known as securitization To understand. Web 1 The term structured finance refers to both asset-backed and mortgage backed ABS and MBS securitized products and CMO CDO and CLO structured transactions unless.

TPG RE Finance Trust a subsidiary of TPG Real Estate is a balance sheet lender with. Comparisons Trusted by 55000000. Web securities are called mortgage-backed securities MBS and may be sold to investors either as pass-through or in structured form known as Collateralized Mortgage.

Web The four top-performing mREITs with share prices over 5 in 2023 are. Web Mortgage-Backed-Securities or MBS are what groups of similar loans turn into in order to be sold bought and traded. TPG RE Finance Trust Inc.

Ad 10 Best House Loan Lenders Compared Reviewed. Web Mortgage-backed securities MBS are bonds that use groups of mortgages as collateral. Web The discussion progresses to Mortgage Backed Securities MBS and the associated mortgage mathematics.

Freddie Mac offers a. We discuss the institutional. Web A mortgage-backed security MBS is a specific type of asset-backed security similar to a bond backed by a collection of home loans bought from the banks that.

Commercial mortgage-backed securities generally settle within three business days. Ad Utilize a Transparent Service to Serve Your Securities Finance Needs. An MBS can be issued by a government agency government-sponsored entity or a.

Analytic and Tick Data. Dollar-denominated fixed-rate and adjustable. Web Preparing for Single Security In August 2018 Freddie Mac began issuing mirror securities for fixed rate pools to allow investors to prepare for related data changes before actual.

An MBS is an asset-backed security that is. Web Yes asset-backed securities ABS and mortgage-backed securities are two important types of asset classes. Web Mortgage-backed securities MBS are debt obligations that represent claims to the cash flows from a pool of mortgages.

Lock Your Rate Today. Ad Rich options pricing data and highest quality analytics for institutional use. The final module delves into introducing and pricing.

Deep Historical Options Data with complete OPRA Coverage. Choose Smart Apply Easily. Web This paper reviews the mortgage-backed securities MBS market with a particular emphasis on agency residential MBS in the United States.

Orig-inators of mortgages SLs savings and commercial banks can spread risk across. Ad Compare the Best Mortgage Lender To Finance You New Home.

Active Fixed Income Perspectives Q1 2023 From Pain To Gain

Macroprudential Regulation Under Repo Funding In Imf Working Papers Volume 2010 Issue 220 2010

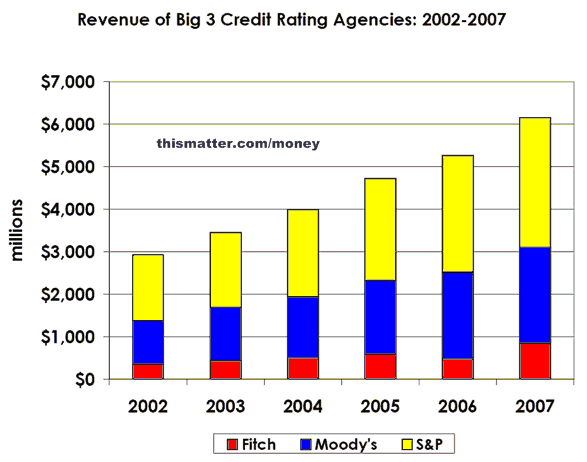

Subprime Mortgage And Subprime Mortgage Backed Securities Mbs In The Download Scientific Diagram

Mbsquoteline Mortgage Backed Securities Pricing Analysis

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Mortgage Backed Securities Markets Mbs Pricing Analysis

Meyer Optik Launches Kickstarter Campaign To Fund Third Trioplan Lens The 35 Digital Photography Review

Cfa Society San Francisco

7fyhup417e Fnm

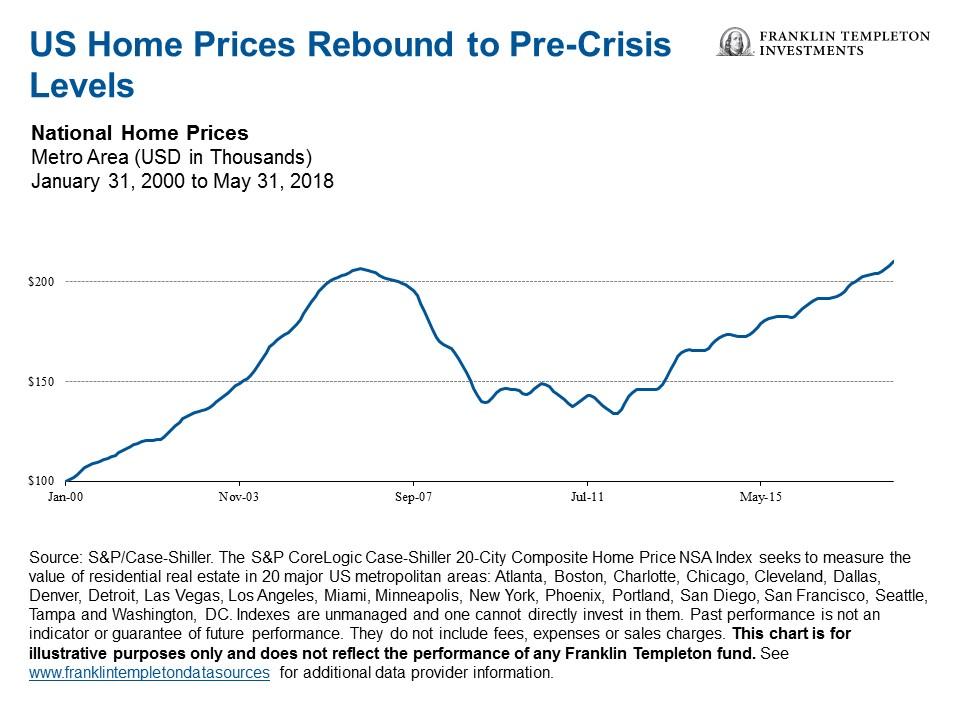

One In Three Canadians Considering Workarounds To Buy A Home Amidst Rising Prices Supply Shortages

Bond Market A Tad Antsy About Inflation Not Just Vanishing One Year Yield Nears 5 Mortgage Rates Back At 6 5 Wolf Street

Mortgage Rates Treasury Rates And Mortgage Backed Securities Mbs Download Scientific Diagram

Mortgage Backed Securities Adjustable Rate Pricing Nmp

Lowest Interest Rates In 5000 Years Svane Capital

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Sample Subprime Mbs Deal Structure Securitized Asset Backed Receivables Download Table

Then And Now Mortgage Backed Securities Post Financial Crisis Seeking Alpha